To help achieve its vision, the FCA wants:

a. The process of finding the right mortgage to be easier for consumers.

b. A wider range of tools providing consumers with a choice about the support (including advice) that they receive.

c. Consumers choosing an intermediary to be able to do so on an informed basis.

d. Consumers to be able to switch more freely to new deals without undue barriers.

Also, the FCA published early in 2018 a 'Dear CEO' letter asking the chief executives of firms that enter into regulated second charge mortgage contracts to review their firm’s mortgage lending processes and to confirm to the regulator, by 1 May 2018, that the firm was lending responsibly and that its processes, systems and controls ensured this.

Mr Maner points out: “During this review, the FCA identified significant concerns and found a number of poor practices that led it to conclude that second charge lenders might not always be lending responsibly, leading to potential customer harm.

“The Dear CEO letter described failings in the following areas: overall affordability assessment, income assessment, expenditure assessment, oversight arrangements and financial crime."

Pensions

In the pensions space, the FCA wants to ensure that regulation provides the appropriate level of consumer protection and competition, whether this is through the establishment of independent governance committees or ongoing work, such as the Retirement Outcomes Review.

As part of ongoing efforts to ensure the sector works well for consumers and workplace pension savers, the FCA is working on a pensions strategy, collaborating with The Pensions Regulator (the TPR) on a strategic approach which will set out how the FCA and the TPR will work together to tackle the key risks facing the pensions sector over the next five to 10 years.

The initial stage involved a 'Call for Input', which has now closed.

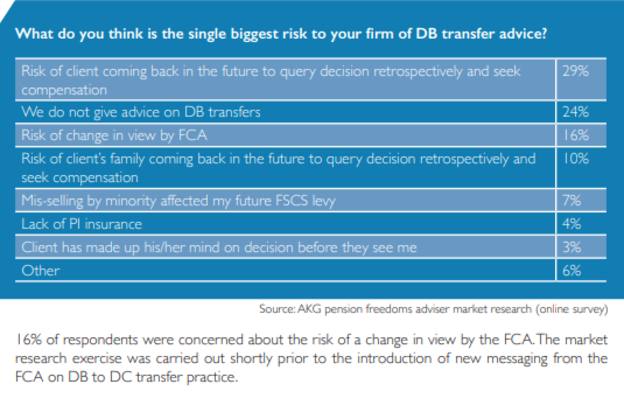

The FCA has also published new rules and guidance on pension transfer advice and is seeking views on additional changes, including adviser charging structures - in particular whether it should ban contingent fees for pension transfer advice.

The regulator says: “The new rules and areas for discussion aim to improve the quality of pension transfer advice to help consumers make informed decisions for their individual circumstances. We have kept the position that an adviser should start from the assumption that a DB pension transfer will be unsuitable.”

Thematic review of non-advised drawdown

The FCA has published a thematic review on non-advised drawdown. It assesses whether firms are providing necessary information at the right time and in a way that helps customers make informed decisions when accessing retirement benefits – as well as when reviewing whether their drawdown pension still meets their needs.