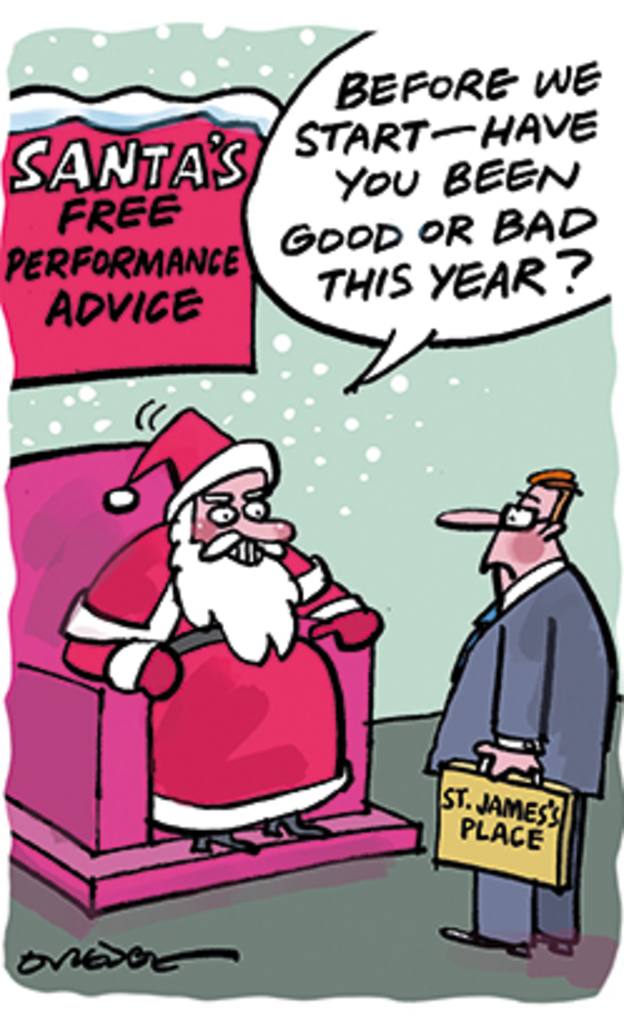

It must be the season of goodwill, because on Twitter I saw a financial adviser pose the question: “Instead of criticising St James’s Place, should we not try to acknowledge some of the successes of its business model?”

I do not think I really need to tell you the type of comment that was posted in reply, but the general tone contained accusations of hard-sales techniques, misaligned incentives, and lack of transparency over fees, particular ‘exit fees’ (which it says it does not have).

The initial tweet does raise a good thought though, namely that instead of constantly berating SJP, one might consider whether there are some actual benefits to its business worth acknowledging.

It is, after all – at least valued by its revenues and profits – a highly successful model.

It gives a lot to charity, which is admirable, and there is no doubt that it has delivered high rewards to shareholders.

Many, in fact I would argue the majority, of its partners are incredibly loyal and love working for the business. They will defend its techniques to the hilt, even long after they have left.

There are, of course, advisers who fall out, and over the years I have spoken to many recent recruits who left because they did not like what they were being asked to do. But you get that with any business, particularly those that recruit very heavily every year.

From a client point of view, I think the tax planning element of the business is the most worthwhile feature of the SJP model.

Having spoken to a large number of its clients over the past two years – happy and unhappy – the thing that unites them all is the general level of satisfaction over this feature of advice.

The consensus is that this feels ‘free’ (I know, I know, please don’t start...) and so most mitigation and planning feels like something an individual could not have done themselves.

And perhaps there is an argument to say that most other advisers are not aggressive enough in their approach to sales – competition breeds innovation and in many respects the advice sector has been slow to embrace new technology and rationalise.

These are all ugly business words, but are crucial to the modern commercial world that we all have to operate in.

No matter which way you cut it, the hard part of the SJP model is the interaction between fees and performances.

It is the same old story with their investments, whichever way you try to analyse performance the business disagrees with that assessment because of the way that advice fees are bundled together.

Yet also you do not have to be a genius to see that – fees included or not – some of its funds are absolute rotters.

And when an adviser only has a limited choice of investments, of which some are pathetically bad, that rankles – particularly if that same adviser is taking a lovely ongoing fee for recommending it.