A number of government schemes have been launched in recent years which can also help clients get onto the property ladder without stretching themselves financially.

Mr Duncombe suggests: “Brokers should educate their clients on the variety of schemes available which can help first-time buyers onto the property ladder.

“Shared ownership, Help to Buy, or even support from the Bank of Mum and Dad can give potential buyers the boost they need to secure homeownership.”

Making clients aware of these schemes and whether they are eligible could help those credit-impaired borrowers who are buying for the first time.

The two best-known schemes are Help to Buy: Equity Loan and Help to Buy: Shared Ownership.

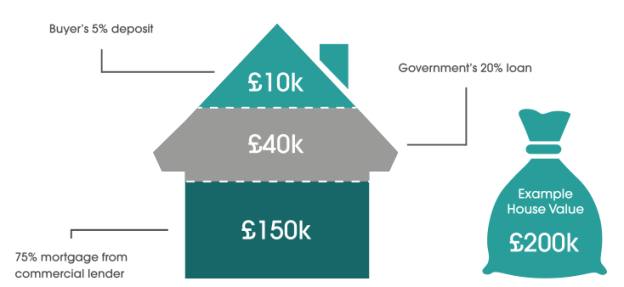

The former means it is possible for someone with a 5 per cent deposit to purchase a property, while the latter scheme also requires a lower than usual deposit.

Under the Shared Ownership scheme, buyers are able to purchase as little as 25 per cent or as much as 75 per cent of their home and then pay rent on the rest.

Figure 1: Help to Buy Equity Loan - example for a home with a £200,000 price tag

Source: www.helptobuy.gov.uk

Ray Boulger, senior technical mortgage manager at John Charcol, explains: “The Help to Buy equity share second charge scheme helps to reduce risk as mortgage payments are much lower for the same value property and, as the government shares in any increase or decrease in the value of the property, only part of the reduction in value falls on the purchaser.”

The Help to Buy Isa offers another avenue for first-time buyers to save a deposit as each payment into the Isa receives a government top-up of 25 per cent of the savings, up to £3,000.

Knowing what options are open to them is part of the process for borrowers with adverse credit.

Being aware of the risks associated with having to pay a mortgage each month is also important, but being able to remove any risks entirely is unlikely.

Mr Boulger admits: “One can’t completely eliminate risk, but it can be mitigated by sensible financial planning for known events which would result in a reduction of income – such as starting a family – and unplanned events, such as redundancy, by keeping readily available savings of, say, three months’ expenditure.”

eleanor.duncan@ft.com