Half of all investment companies are owned by institutions, a report has found.

The Association of Investment Companies found institutions own 50 per cent of investment company shares by value.

This is equivalent to £89bn of the holdings that were analysed.

To compare, wealth managers hold 25 per cent and private investors hold 23 per cent, while adviser platforms hold just 2 per cent.

Richard Stone, chief executive of the AIC, said: “It reveals that our shareholder base is as diverse as investment companies themselves, from the largest institutions and wealth managers all the way through to financial advisers and private investors holding shares on platforms.

“This has always been the case, from the days when investment companies were invented in 1868 to provide the investor of moderate means with the same advantages as large, sophisticated investors.”

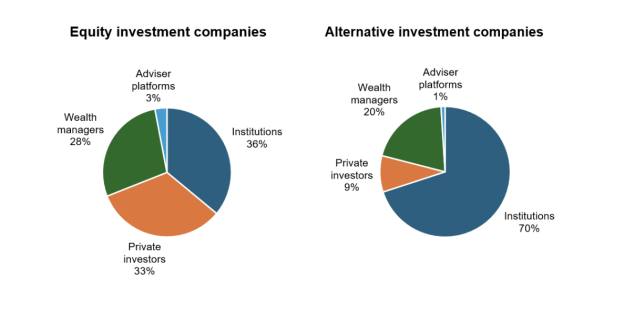

The report went a step further and broke down the ownership of equity compared with alternative investment companies.

This showed institutions favoured alternative investment companies with 70 per cent of the share, compared with 36 per cent in companies that invest in equities.

Private investors, on the other hand, held 33 per cent of equity investment companies and 9 per cent in alternative investment companies.

While wealth managers make up slightly more of the shareholder base of equity investment companies (28 per cent) than they do of alternative investment companies (20 per cent).

The analysis covered £177bn of shareholdings, representing 87 per cent of the industry’s market capitalisation excluding VCTs at the end of December 2023.

Stone added: “Investment companies are a UK success story, giving investors access to a wide range of global opportunities and channelling capital into the drivers of future economic growth, such as infrastructure and the transition to net zero.

“We will update this analysis regularly to follow trends in the industry’s shareholder base and draw out more insights from the data.”

The report also listed the 20 largest institutional investors in investment companies, the 20 largest wealth managers, and the most significant retail and adviser platforms.

The report listed the most significant adviser platforms as Transact, Embark and Raymond James.

The top three institutional investors were Blackrock, European Clearing and Columbida Threadneedle.

tara.o'connor@ft.com

What's your view?

Have your say in the comments section below or email us: ftadviser.newsdesk@ft.com.