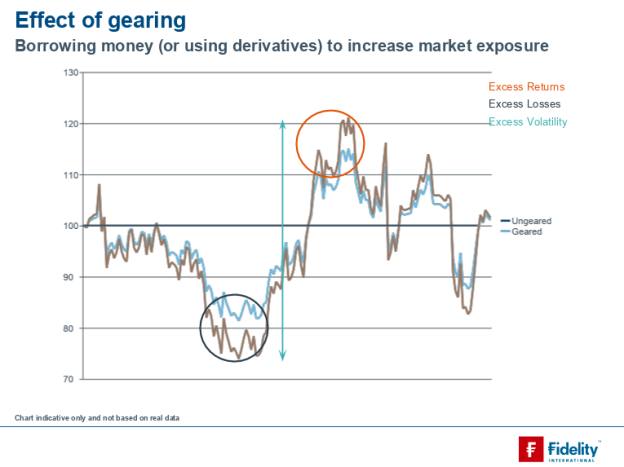

He explains: “But markets are volatile and, while gearing can amplify returns in positive markets, so they also amplify losses in down markets.

“However, we all hope that markets will go up over the long-term and our investment managers can exploit those periods of volatility to their advantage, so the effect of gearing should be positive.”

Because some sectors and portfolios are more volatile than others, it is important for advisers to consider the gearing in that context too, and to remember that it is not as easy as saying that gearing is ‘good’ or ‘bad’; it must be taken on a case-by-case basis, he continues.

Gearing often takes the form of a short-term overdraft or a longer-term fixed rate loan called a debenture, explains Melissa Gallagher, co-head of investment trusts at BlackRock.

She continues: “If an investment trust has £100m and borrows £10m, the fund manager can invest £110m on behalf of its investors, which means the investment trust is 10 per cent geared."

Ms Gallagher notes: “Fund managers gear up or gear down depending on whether they are positive or negative about stock markets; they will look to reduce gearing when markets look expensive and increase it when markets look cheap.”

So effectively, gearing, usually expressed as a percentage, is calculated by dividing the company’s debt by its equity, and each trust will have a gearing limit, agreed by its board, which is expressed as a percentage of net assets, adds Mr Burrows.

Mr Burrows points out: “Gearing equivalent to 10 per cent of the portfolio in a ‘slow and steady’ sector with a diversified portfolio of 100 stocks may be acceptable, but in a highly volatile sector with a concentrated portfolio, it could be considered too racy.”

He continues: “[Gearing] enables investment trusts to be more nimble and take full advantage of buying opportunities without having to sell down current holdings to fund those purchases.

“This is vital when you consider the importance of a long-term time horizon when investing in the markets.”

Source: Fidelity International

victoria.ticha@ft.com