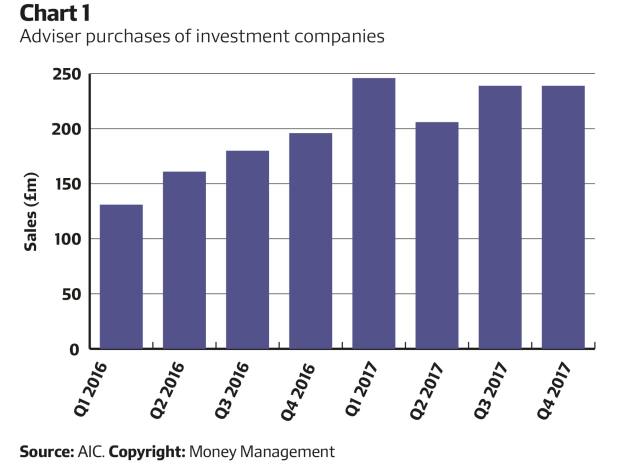

A few independent financial advisers have appreciated the business advantages of recommending investment trust companies to their clients, with purchases of nearly £1bn in 2017, but there remain considerable obstacles to the average intermediary.

Inherent bias

Chart 1 shows how interest has gradually increased since 2016. But a new report by specialist consultancy the Lang Cat identifies an “inherent market bias against investment companies” that takes many forms, such as the march towards vertical integration, the influence of networks, and the outsourcing of investment decisions to discretionary fund managers (DFMs) that don’t use investment companies in their model portfolios.

The Lang Cat’s analysis of the cost structures of adviser platforms reveals another considerable barrier to the wider uptake of investment companies.

The majority of platforms “remain hooked on the drug of unlimited percentage-based charging”, the report says, in contrast to many direct-to-consumer platforms where custody charges are capped or eliminated for investment company investors. That “unlimited percentage-based charging” is what makes unit trusts so unsatisfactory as an investment.

When it comes to the model portfolios used by DFMs and an increasing number of advisers to segment their client bases, the report finds there are many platforms where the cost of incorporating anything other than open-ended funds is “prohibitive”.

Watching costs

Stockmarket returns have never been generous compared with buying and selling goods, or creating businesses. They are small, and require years if they are to compound into fortunes. Thus investment costs have always been important to results, and are ignored by investors and advisers alike at their peril.

The Association of Investment Companies (AIC) is doing its best to persuade the FCA that competition between different styles of asset management, and different structures, are as important as analysis of annual results. But financial advisers might do better to remember Occam’s razor. This idea, attributed to a 14th century scholar, is the rule of thumb that suggests the simpler solution tends to be the right one.

The current investment philosophy embraced by the FCA goes back to the computer and the 1940s; that of the traditional investment company stretches back through hundreds of years of history.

There have always been people with cash, needing an income, and entrepreneurs with ideas wanting cash. First merchants, and then bankers, were the intermediaries. The successful were those that ensured the former did not lose their capital, because the latter knew what they were doing.

Such a service deserved a fee, which is why merchants and bankers became the richest people within their societies. Today, the world is far richer than it ever was, and more people have more money than ever before, but the need for safe income remains, as does the need for honest and intelligent advisers.

As Brexit negotiations enter their last few months, all sorts of fears are developing, from food and medicine shortages to a collapse of air transport. Whether talks are successful or not, no one can foresee, let alone predict, the outcome for the British economy, or the behaviour of sterling and the trend of the London stockmarket.