Nearly three-quarters of advisers say it is “impossible” to prejudge a provider’s service, research from the Lang Cat has revealed.

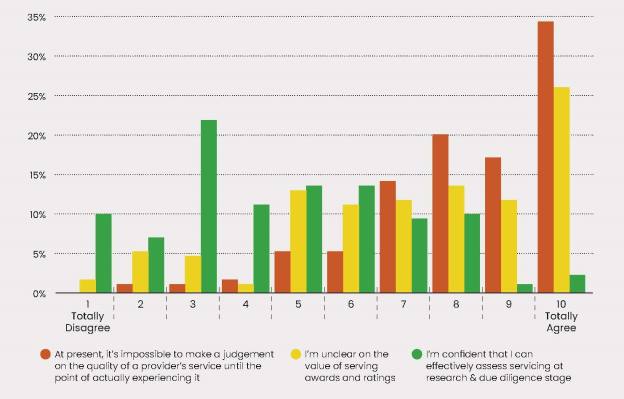

The research, which was conducted for the Lang Cat's latest white paper, Answering the Call, was supported by Abrdn and reported that 71 per cent of advisers said it was impossible to make a judgement on the service of a provider before actually experiencing it.

This is in contrast to the 2 per cent of the 212 respondents who thought they could prejudge a provider’s service.

These findings were echoed in the sentiments expressed by the research's survey respondents, such as: “There’s no way to review [a provider] unless you get your hands dirty and just try it, by which point it can be too late.”

“So much of it is down to personal experience. You often hear the good and bad stories, but I don’t really know how you would know if [providers] are good or not,” another respondent stated.

It was also reported that the “vast majority” of participants agreed that different firms and different role types will have different requirements from a service perspective.

Additionally, the research revealed that more than half (51 per cent) of those surveyed agreed that they were “unclear on the value of service awards and ratings”, while only 13 per cent disagreed.

Steve Nelson, insight director at the Lang Cat, said: “Service means a lot of things to a lot of different people. It’s almost intangible due to its subjectivity.

"So, why do we in financial services so frequently combine a plethora of service-related activities into a single rating or award?”

Nelson suggested that the solution to this issue should be “multifaceted” and that a set of agreed, well defined, measurable data points to compare service providers against would be necessary.

“This is going to need significant thought and widespread buy-in to get right”, he continued.

Outlining the importance of service, Johnny Black, chief commercial and strategy officer at Abrdn, added: “When you get service right, it can radically improve the ability for advisers to deliver for their clients. When you get service wrong, it ripples everywhere - the pain is disproportionate. “

Black added that, as a result, it’s “vital” that the industry engages to drive constant improvements both in the service being delivered, but as importantly in transparency and measurement.

Last month, Abrdn introduced adviserOS which will see the current platforms Wrap, Elevate and Fundzone sit together on one common tech stack.

The firm said this approach to platforms will enable advisers to do less, achieve more for their clients and grow their business.

tom.dunstan@ft.com